What Exactly Are NYC Flood Zones?

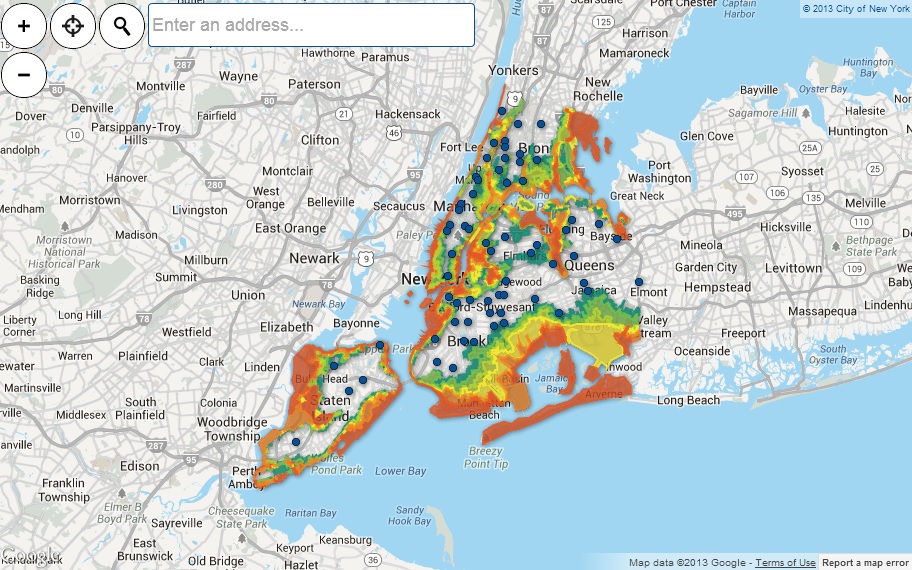

At its core, a flood zone is a geographic area that the Federal Emergency Management Agency (FEMA) has defined according to varying levels of flood risk. These zones are depicted on a Flood Insurance Rate Map (FIRM), which is the official map used for floodplain management and insurance purposes. The primary goal of these maps is to identify areas that are at high risk of flooding.

Decoding the FEMA Flood Insurance Rate Maps (FIRMs)

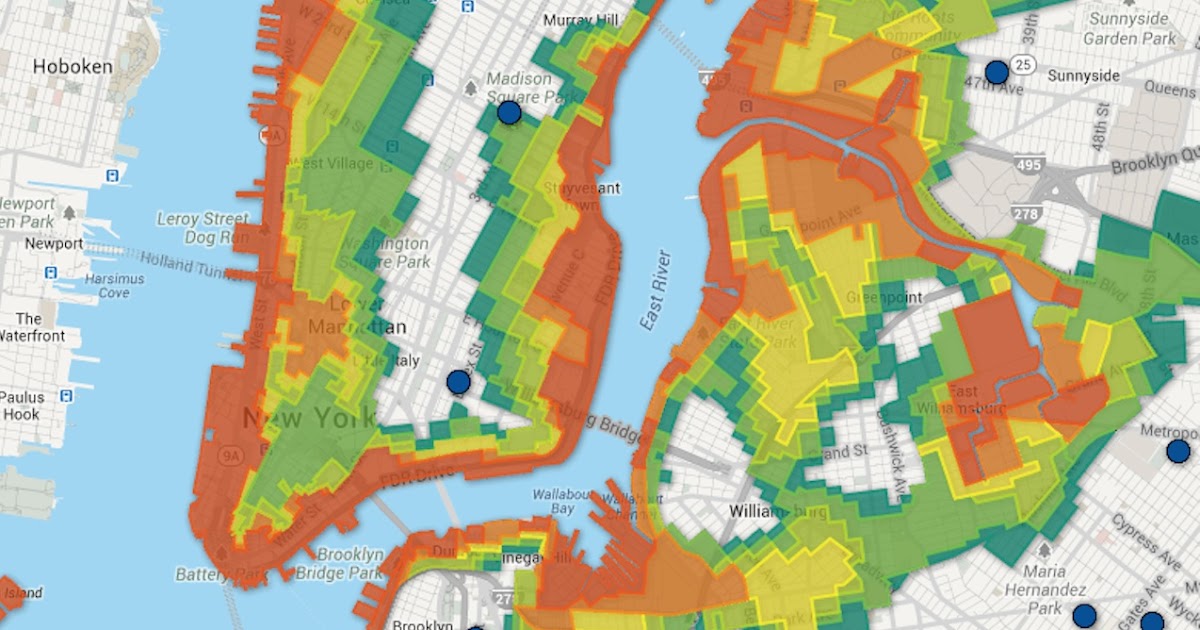

- Zone A (or AE): These are high-risk areas within the SFHA. In Zone AE, FEMA has determined Base Flood Elevations (BFEs), which are the anticipated water surface elevations during a 1% annual chance flood. These BFEs are critical for setting flood insurance rates and establishing building regulations.

- Zone VE: This is a coastal high-risk zone with the added danger of storm-induced wave action of 3 feet or more. These are among the most hazardous areas and are subject to the strictest building codes. Properties in Zone VE are typically beachfront or directly exposed to open water.

- Shaded Zone X: These areas represent moderate flood risk. They are located between the limits of the 1% annual chance flood and the 0.2% annual chance flood (also known as the ‘500-year flood’).

- Unshaded Zone X: These zones are considered to have a minimal flood risk. However, it’s vital to remember that ‘minimal risk’ does not mean ‘no risk’. Events like Hurricane Ida in 2021 demonstrated that intense, localized rainfall can cause devastating flooding far outside of designated high-risk zones.

How to Find Your Property on the NYC Flood Zone Map

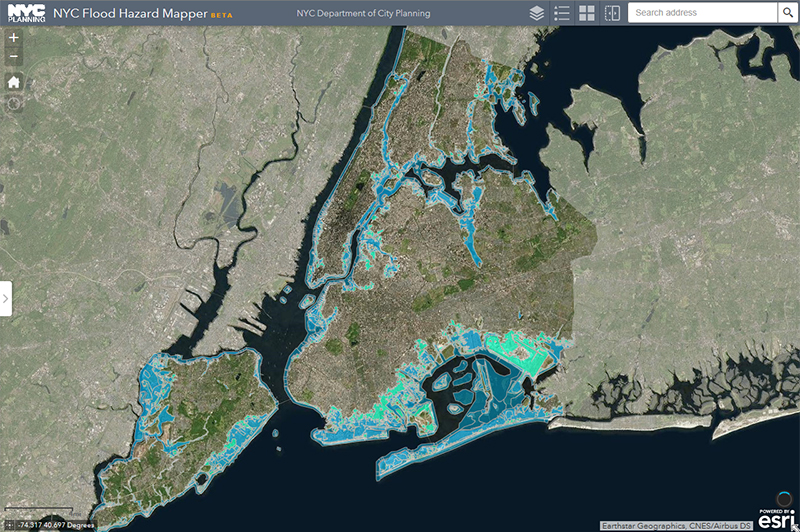

Finding your specific property’s flood zone designation is a straightforward process thanks to online tools. The most reliable and user-friendly resource for residents is the NYC Flood Hazard Mapper.

- Step 1: Navigate to the official NYC Flood Hazard Mapper website.

- Step 2: Enter your full property address into the search bar.

- Step 3: The map will center on your property, displaying a color-coded overlay that indicates the flood zone.

- Step 4: Click on your property to view detailed information, including the specific flood zone (e.g., Zone AE), the Base Flood Elevation (if applicable), and links to the relevant FEMA FIRM panel.

Alternatively, you can use the national FEMA Flood Map Service Center, which provides access to the official FIRMs for the entire country. While slightly less user-friendly for a quick address lookup, it is the ultimate source of truth for all flood map data.

The Impact of Flood Zones on Homeowners and Renters

Knowing your flood zone is about more than just satisfying curiosity; it has significant real-world implications, particularly concerning insurance and building regulations.

Mandatory Flood Insurance Requirements

This is perhaps the most direct impact. If your property is located within a Special Flood Hazard Area (Zone A, AE, or VE) and you have a mortgage from a federally regulated or insured lender, you are legally required to purchase flood insurance.

It is a common and costly misconception that standard homeowner’s or renter’s insurance policies cover flood damage. They do not. Flood insurance must be purchased as a separate policy. The primary source for this coverage is the National Flood Insurance Program (NFIP), which is managed by FEMA. Private flood insurance policies are also becoming more widely available and may offer competitive rates or broader coverage options.

Even if you are not in an SFHA, purchasing flood insurance is a wise investment. FEMA data shows that over 25% of all NFIP flood claims occur in moderate-to-low-risk areas (Zone X).

Building Codes and Construction Regulations

Your property’s flood zone dictates specific construction and renovation standards enforced by the NYC Department of Buildings. The goal of these regulations is to minimize future flood damage and enhance building resiliency.

- Elevation: New construction and substantially improved buildings must be elevated so that the lowest floor (including basements) is at or above the Base Flood Elevation.

- Flood-Resistant Materials: Any portion of a building below the BFE must be constructed with materials that are resistant to flood damage.

- Utility Protection: Electrical, plumbing, and HVAC systems must be elevated or designed to prevent water from entering or accumulating within the components.

- Flood Vents: Enclosed areas below the BFE, like crawlspaces or garages, must have openings (flood vents) to allow floodwaters to enter and exit, equalizing pressure and preventing structural damage.

Future Projections: Climate Change and NYC’s Evolving Floodplain

The flood maps we use today are a snapshot in time. The reality is that New York City’s flood risk is dynamic and increasing due to climate change. Rising sea levels and the increasing frequency of intense storm events are actively expanding the city’s floodplain.

Hurricane Sandy in 2012 was a tragic catalyst, exposing the vulnerability of vast areas of the city and prompting a major re-evaluation of flood risk. In the years since, FEMA has been working on updated Preliminary Flood Insurance Rate Maps (PFIRMs) that show a significantly larger high-risk flood zone, encompassing tens of thousands of additional buildings.

The New York City Panel on Climate Change (NPCC) projects that by the 2050s, the city could experience sea level rise of up to 30 inches. This means that today’s ‘100-year’ flood could become much more frequent, and areas currently in moderate-risk zones could become high-risk zones. It is therefore crucial to not only look at the current effective FIRMs but also consider these future projections when making long-term property decisions.

Frequently Asked Questions (FAQs)

Does my standard homeowner’s insurance policy cover flood damage?

No. This is a critical point. Damage from flooding—defined as an excess of water on land that is normally dry, affecting two or more acres of land or two or more properties—is excluded from virtually all standard homeowner’s and renter’s insurance policies. You must purchase a separate flood insurance policy.

What is the difference between a 100-year flood and a 500-year flood?

These terms refer to statistical probabilities. A 100-year flood has a 1% chance of occurring in any given year. A 500-year flood has a 0.2% chance of occurring in any given year. It does not mean these events happen only once in that time frame; they can occur multiple times in a short period or not at all for centuries.

How can I lower my flood insurance premium?

Premiums are based on risk. You can lower them by reducing your property’s risk. Methods include: obtaining an Elevation Certificate to prove your home’s lowest floor is above the BFE, installing flood vents in foundation walls, elevating utilities like your furnace and water heater, and choosing a higher deductible.

Protecting Your Property: Mitigation and Preparedness

Beyond insurance, there are physical steps you can take to make your property more resilient to flooding. These mitigation efforts can significantly reduce the potential for damage.

- Elevate Utilities: Move your furnace, water heater, and electrical panels to a higher floor or elevate them on a platform above the anticipated flood level.

- Install Backflow Preventers: Fit your sewer and drain lines with valves to prevent floodwaters from backing up into your home.

- Improve Grading: Ensure the ground around your foundation slopes away from the building to direct rainwater away.

- Waterproof Your Basement: Apply sealants to basement walls and consider installing a sump pump with a battery backup.

In addition to physical mitigation, personal preparedness is key. Have an emergency plan, assemble a ‘go-bag’ with essential supplies, and sign up for emergency alerts from Notify NYC.

Conclusion: Planning for a Resilient Future

The NYC flood zones map is more than just a regulatory tool; it is a critical resource for understanding and managing the tangible risks our coastal city faces. Flood risk in New York is not a distant threat—it is a present and growing reality. By using the NYC Flood Hazard Mapper, understanding your zone’s implications, securing the right insurance coverage, and taking proactive mitigation steps, you can safeguard your property and contribute to a more resilient city for all. Don’t wait for the next storm to find out your risk. Be informed, be prepared, and be proactive.