Navigating the Labyrinth: Understanding the Hennepin County Property Tax Map

Hennepin County, Minnesota, a bustling hub of commerce and group, is residence to an enormous and various panorama of properties. From sprawling lakeside estates to cozy city flats, every property contributes to the county’s general tax base. Understanding how property taxes are assessed and managed is essential for owners, potential patrons, and anybody within the county’s fiscal well being. On the coronary heart of this understanding lies the Hennepin County Property Tax Map, a strong instrument that gives a visible and informative gateway to property-related info.

This text delves into the intricacies of the Hennepin County Property Tax Map, explaining its objective, performance, knowledge sources, and the way it may be used successfully to entry very important details about properties throughout the county. We’ll discover the map’s options, the sorts of knowledge it gives, and the potential purposes for numerous stakeholders.

What’s the Hennepin County Property Tax Map?

The Hennepin County Property Tax Map is an interactive, on-line Geographic Info System (GIS) platform designed to offer entry to property-related knowledge. It overlays property boundaries and parcel info onto a geographical map of Hennepin County, permitting customers to visually determine properties and entry related particulars. This map serves as a central repository for info associated to property taxes, assessments, possession, and different related attributes.

Consider it as a digital atlas that gives an in depth snapshot of the county’s actual property panorama, layered with priceless knowledge that empowers customers to make knowledgeable choices. It is a essential useful resource for understanding the property tax system in Hennepin County.

Goal and Performance:

The first objective of the Hennepin County Property Tax Map is to offer clear and accessible details about properties throughout the county. It serves a number of key features:

- Property Identification: The map permits customers to shortly and precisely determine properties primarily based on their location, tackle, or parcel quantity.

- Information Entry: It gives direct entry to a wealth of property-related knowledge, together with assessed values, property taxes, possession info, constructing traits, and extra.

- Transparency and Accountability: By making property info available, the map promotes transparency within the property tax system and fosters accountability amongst county officers.

- Analysis and Planning: The map serves as a priceless instrument for researchers, planners, and builders who want to investigate property traits, determine potential growth websites, and perceive land use patterns.

- Citizen Engagement: It empowers residents to know how their property taxes are calculated and the way they contribute to the funding of important county companies.

Accessing the Map:

The Hennepin County Property Tax Map is often accessible by the Hennepin County web site. The web site gives a user-friendly interface that permits customers to simply navigate the map and entry the specified info. The hyperlink is often discovered underneath the "Property Info" or "Taxes" part of the web site.

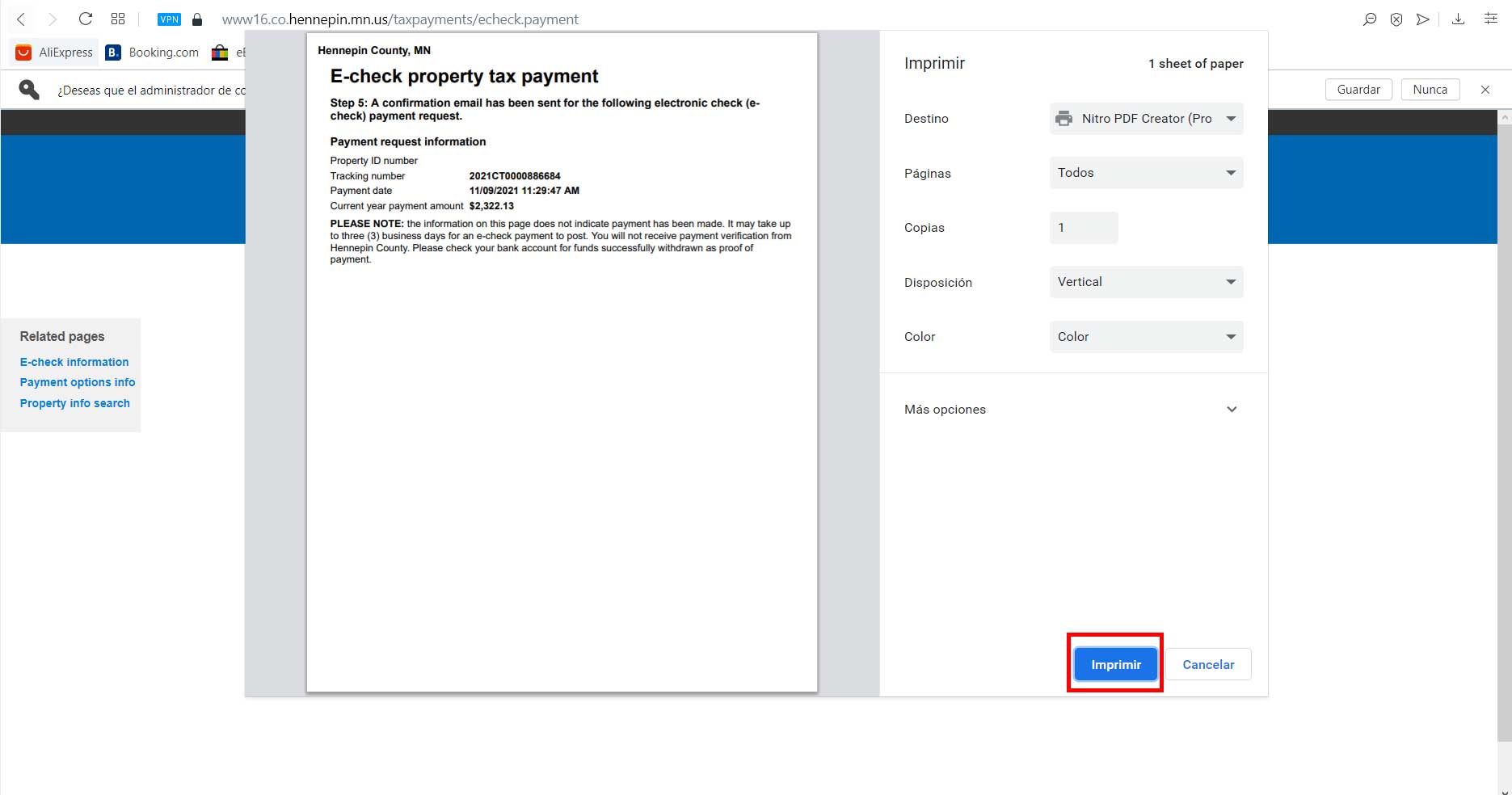

Navigating the Map: A Step-by-Step Information:

Utilizing the Hennepin County Property Tax Map is comparatively simple. This is a step-by-step information that will help you navigate the map and entry the data you want:

- Entry the Map: Start by visiting the Hennepin County web site and finding the hyperlink to the Property Tax Map.

- Zoom and Pan: Use the zoom and pan instruments to navigate to the realm of curiosity. You possibly can zoom in to view particular person properties or zoom out to get a broader overview of the county.

- Seek for a Property: Make the most of the search bar to discover a particular property by tackle, parcel quantity, or proprietor identify. The map will robotically zoom to the situation of the property.

- Determine the Property: As soon as you have positioned the property, click on on it to entry its related info. A pop-up window or sidebar will seem, displaying numerous particulars concerning the property.

- Discover the Information: Look at the info displayed within the pop-up window or sidebar. This will embrace details about the property’s assessed worth, property taxes, possession, constructing traits, and extra.

- Use Further Instruments: The map could supply further instruments, equivalent to measuring instruments, layer controls, and printing choices. Discover these instruments to boost your understanding of the property and its environment.

- Confer with Documentation: When you’ve got any questions on utilizing the map or deciphering the info, check with the web documentation or contact the Hennepin County Assessor’s Workplace for help.

Information Sources and Accuracy:

The information displayed on the Hennepin County Property Tax Map is compiled from numerous sources, together with the Hennepin County Assessor’s Workplace, the Hennepin County Recorder’s Workplace, and different county departments. The accuracy of the info is paramount, and the county strives to keep up up-to-date and dependable info.

Nonetheless, it is necessary to notice that knowledge could also be topic to alter and that errors can happen. Due to this fact, it is at all times advisable to confirm info with the official sources earlier than making any choices primarily based on the info displayed on the map.

Varieties of Information Obtainable:

The Hennepin County Property Tax Map gives entry to a variety of property-related knowledge, together with:

- Parcel Info: This contains the parcel quantity, tackle, authorized description, and different figuring out details about the property.

- Possession Info: This contains the identify and tackle of the property proprietor.

- Assessed Worth: That is the worth assigned to the property by the Hennepin County Assessor’s Workplace for property tax functions.

- Property Taxes: This contains the quantity of property taxes levied on the property, in addition to details about tax charges and tax districts.

- Constructing Traits: This contains details about the scale, age, and kind of constructing on the property.

- Gross sales Historical past: This contains details about previous gross sales of the property, together with the sale value and date of sale.

- Zoning Info: This contains details about the zoning designation of the property.

- Environmental Info: This will embrace details about environmental hazards or restrictions on the property.

- Aerial Imagery: The map usually contains aerial imagery that gives a visible illustration of the property and its environment.

- Floodplain Info: This means if the property is positioned inside a delegated floodplain.

- Wetland Info: This means if the property incorporates wetlands.

Functions for Totally different Stakeholders:

The Hennepin County Property Tax Map is a priceless useful resource for a variety of stakeholders, together with:

- Owners: Owners can use the map to know their property taxes, examine their assessed worth to comparable properties, and observe property values of their neighborhood.

- Potential Patrons: Potential patrons can use the map to analysis properties they’re fascinated about buying, assess property taxes, and determine potential points, equivalent to environmental hazards or zoning restrictions.

- Actual Property Professionals: Actual property professionals can use the map to analysis properties, determine potential shoppers, and observe market traits.

- Researchers and Planners: Researchers and planners can use the map to investigate property traits, determine potential growth websites, and perceive land use patterns.

- Builders: Builders can use the map to determine potential growth websites, assess property values, and analysis zoning rules.

- Authorities Officers: Authorities officers can use the map to handle property taxes, plan infrastructure tasks, and monitor land use.

- The Normal Public: Most people can use the map to study property taxes, perceive how they contribute to the funding of important county companies, and observe property values of their group.

Limitations and Concerns:

Whereas the Hennepin County Property Tax Map is a strong instrument, it is necessary to pay attention to its limitations and concerns:

- Information Accuracy: As talked about earlier, the info displayed on the map could also be topic to alter and that errors can happen. All the time confirm info with the official sources earlier than making any choices primarily based on the info.

- Map Scale: The map’s accuracy and element could fluctuate relying on the size at which it’s seen.

- Interpretation: Decoding the info displayed on the map requires some understanding of property tax evaluation and land use rules.

- Accessibility: Whereas the map is mostly accessible on-line, entry could also be restricted for people with disabilities or these with out web entry.

- Authorized Recommendation: The knowledge supplied on the map shouldn’t be thought-about authorized recommendation. Seek the advice of with a professional authorized skilled for authorized recommendation associated to property issues.

Conclusion:

The Hennepin County Property Tax Map is a useful useful resource for understanding property taxes, accessing property-related knowledge, and navigating the county’s actual property panorama. By offering a visible and informative gateway to property info, the map empowers owners, potential patrons, researchers, planners, and authorities officers to make knowledgeable choices. Whereas it is necessary to pay attention to the map’s limitations and concerns, its advantages far outweigh its drawbacks. By understanding use the map successfully, you may unlock a wealth of knowledge and achieve a deeper understanding of the property tax system in Hennepin County. This, in flip, can result in extra knowledgeable decision-making and a larger appreciation for the position of property taxes in supporting the group.